Not that long ago in the United States, food production was a bit of a black box; consumers didn’t ask where ingredients came from and manufacturers didn’t volunteer the information. That default trust in the system has eroded over the years, however, and now consumers are much more curious and particular about where their food comes from and how it is made. This shift has put the onus on manufacturers to be more transparent about their operations and supply chains, and consumers increasingly favor products that can demonstrate clear sourcing.

The Shift Away from Assumed Trust

The black box model of food production worked for decades because most consumers operated on default assumptions. If a product was on the shelf at a grocery store, it must be safe. If a brand was recognizable, the ingredients must be acceptable. Questions about sourcing or processing rarely came up because the system itself seemed trustworthy enough not to require scrutiny.

That baseline eroded gradually rather than all at once. Food safety incidents, documentary exposés, and social media amplification of ingredient concerns all played a role. Regulatory changes like the Food Safety Modernization Act formalized new expectations for traceability and accountability in manufacturing. Health-focused consumers began reading food labels more carefully, rejecting products with unfamiliar additives or vague ingredient descriptions. The cumulative effect was a loss of assumed trust in opaque supply chains.

Today’s food manufacturers operate in a different environment. The expectation is no longer that the system works behind closed doors, but that companies can demonstrate how it works if asked. This doesn’t mean every consumer demands to see farm audit reports, but it does mean brands need infrastructure in place to answer questions about ingredient origins, processing methods, and quality controls when those questions arise.1

From Trust to Documentation

As assumptions about food production have faded, manufacturers have had to operate with the expectation that questions will eventually arise about where ingredients came from and how they were handled. It is no longer enough for a supply chain to function smoothly in the background. Brands need to be able to explain their sourcing and processing decisions if scrutiny appears, whether from regulators, retail partners, or increasingly informed customers. In that environment, the ability to account for ingredients becomes part of normal operations rather than a special accommodation.

That accountability depends on documentation that exists long before a finished product reaches the shelf. Ingredients arrive with different levels of visibility attached to them, shaped by how they were grown, processed, and tracked upstream. Some suppliers maintain clear records tying materials back to specific regions, harvests, and processing conditions as a matter of course. Others provide ingredients with little context beyond basic specifications, leaving manufacturers to rely on trust rather than evidence.

The difference between those approaches becomes apparent when something goes wrong or when questions need answers quickly. Manufacturers cannot reconstruct sourcing details after the fact if that information was never captured. In practice, this has shifted the burden upstream, making traceability less about marketing transparency and more about whether an ingredient can stand up to real-world scrutiny as it moves through the supply chain.

Dried Ingredients and Traceability

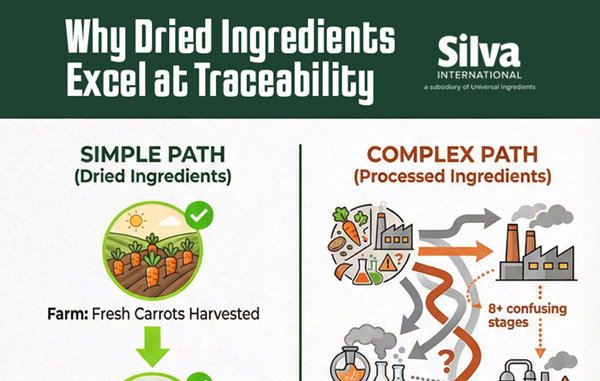

One of the best ways manufacturers can improve transparency and traceability is through the use of dried ingredients that maintain a clear connection to their agricultural origins. A dried carrot is still recognizably a carrot, and details like growing region, harvest timing, and variety remain relevant throughout processing. This retained identity makes traceability straightforward since things like lot codes can connect back to specific fields and harvest dates rather than abstract production batches. The path from farm to manufacturer involves fewer transformation steps, which means fewer facilities to audit and fewer points where documentation might break down.

Processing methods for dried produce also work well with verification requirements. Dehydration uses physical processes like washing, cutting, and controlled drying rather than complex chemical modifications. This simpler path makes supplier audits more manageable because manufacturers can verify practices at the farm level and follow ingredients through a comprehensible production sequence. Documentation ties to concrete agricultural elements like soil testing, pesticide protocols, and grower certifications that stay meaningful when the ingredient hasn’t been transformed beyond recognition.2

Silva’s Dried Ingredient Portfolio

Traceability ultimately has to exist at the ingredient level. Downstream documentation cannot compensate for raw materials that arrive without clear origin or processing history. Silva’s dried fruits, vegetables, as well as spices and herbs are processed to preserve ingredient integrity while supporting the documentation and consistency that food manufacturers require. Here are just a few examples:

- Spinach: Available in flakes or powder, dried spinach appears in soups, sauces, seasoning blends, nutrition mixes, and pet food formulations. The mild flavor and deep green color work across applications while maintaining clear ingredient identity from source through processing.

- Carrots: Offered in sizes ranging from fine powder to larger dices, dried carrots provide natural sweetness, color, and texture to both savory and sweet products. This versatility suits meal kits, dry mixes, baked goods, and pet food applications where consistent performance matters.

- Apples: Dried apple pieces and powders deliver recognizable fruit flavor and subtle sweetness in cereals, snacks, nutrition products, and pet treats. Processing from whole orchard fruit supports formulations that emphasize ingredient clarity and origin.

- Peas: Used across human food, pet food, and specialty products, dried peas contribute texture and plant-based nutrition in extruded products, dry blends, and rehydratable meals. The straightforward agricultural profile supports supply chains where sourcing visibility is expected.

- Herbs (parsley, rosemary, basil): These dried herbs contribute to flavor development while aligning with clean-label and traceability expectations. They appear in seasoning blends, sauces, and pet food formulations where even small inclusions benefit from clear sourcing and processing records.

- Kale: Available in flakes or powder, dried kale appears in supplements, functional foods, and blended formulations. Strong consumer recognition and whole-ingredient identity make it suitable for products positioned around transparency and accountable sourcing.

Contact Silva for More Information

As expectations around accountability and traceability continue to shape food manufacturing, ingredient choices play an increasingly important role in how brands meet those demands. Silva International works with manufacturers to provide dried fruits, vegetables, spices, and herbs that support consistent performance, clear sourcing, and reliable documentation throughout the supply chain. Whether you’re evaluating existing ingredients or developing new formulations, our team can help you find options that align with your production needs. Contact Silva to learn more about our ingredients and capabilities.

1https://www.fda.gov/food/guidance-regulation-food-and-dietary-supplements/food-safety-modernization-act-fsma

2https://www.adm.com/en-us/insights-and-innovation/consumer-trends/trust--traceability/